In our previous newsletter we talked about the types of Stablecoins based on the nature of their collaterals with one of them being crypto backed Stablecoins.

Today we will dive into a specific type of crypto backed Stablecoins - LST backed Stablecoins.

What is LST?

In order to engage in staking on a Proof of Stake (POS) blockchain, it is necessary to lock up tokens to contribute to the network's functioning. As a result, stakers receive rewards in the form of the blockchain's tokens. Nonetheless, this procedure restricts users from fully utilising their staked assets.

Using Ethereum as an example, the minimum number of ETH required to become a validator is 32 ETH, causing staking inaccessible to a wide range of individuals.

LST solved both problems.

LST stands for Liquid Staking Token, it is a representation of staked assets. When a user stakes their assets, they receive LSTs in return, those LST tokens can be sold, traded or put into Defi protocols. It therefore enables holders to retain their control over the staked tokens, avoiding the opportunity cost of missing out in Defi activities.

Why LST backed Stablecoins?

To begin with, an ideal collateral should possess stable market value with relatively low volatility and be easily transferred. LSTs exhibit all these characteristics, making them a good fit as collateral.

By using LSTs as collateral to borrow Stablecoins, users can not only earn yields generated by the collateralised LSTs on the platform, but also utilise their borrowed Stablecoins in other Defi protocols to generate additional yields.

LST backed Stablecoin Examples

Lybra Finance - eUSD

Curve Finance - crvUSD

Raft Finance - R

Prisma Finance - mkUSD

Helio - HAY

Ethena - USDe

Gravita - GRAI

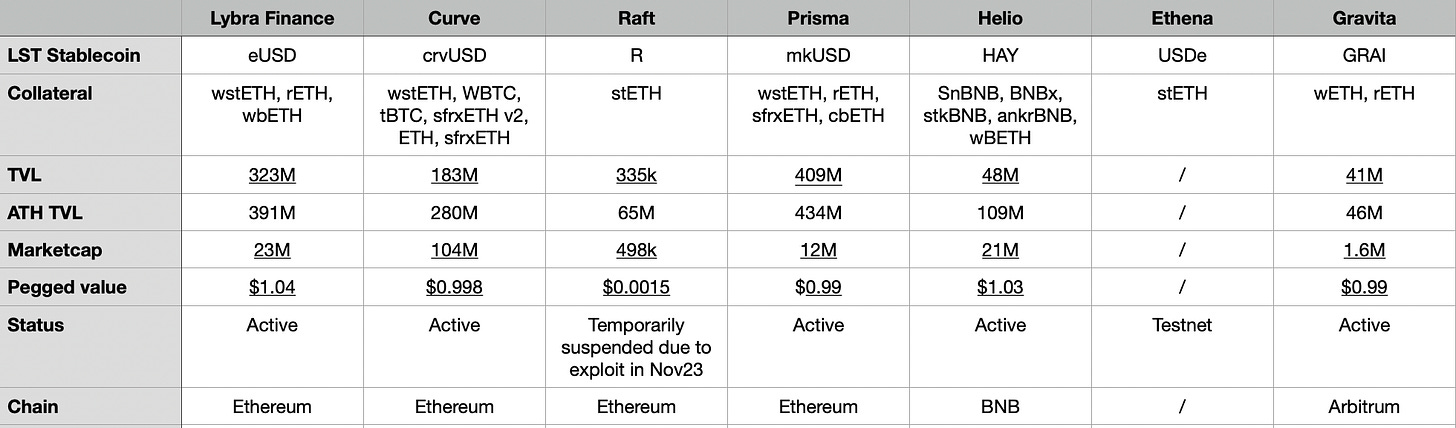

Comparison at a glance

Data as of 21/12/2023 from: defillama

Closing Thoughts

Shanghai upgrade took place in April this year and since then the Ethereum landscape has been evolving.

One of which that has been drawing attention is LSTs and LSTfi.

In view of this, we expect to see more LSTs to be used as collaterals to utilise the inherent value of staked assets.

In particular, LST backed Stablecoins provided a new niche for LSTs, unleashing the possibility of earning more yields for LSTs.

Given the recent emergence of LST backed Stablecoins, it is likely that more participants will be joining the space in the coming year.

Apart from the general functions of Stablecoins like medium of exchange and store of value, another edge of LST backed Stablecoins or Destablecoins (Decentralised Stablecoins) in general is that they abstract centralised actions such as blacklisting and freezing. (see Tether’s recent freeze)

Currently, Centralised Stablecoins account for over 80% of the total Marketcap of Stablecoins. Therefore, it would be nice to see more innovations and creations in the decentralised side, giving more decentralised options within the Stablecoin landscape.

As the market progresses, we eagerly anticipate to see if LST backed Stablecoins will play a pivoting role in the upcoming bull run.